| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 |

Tags

- correlatiom

- kospi

- volume

- 069500

- ChatGPT

- KODEX200

- Inovio Pharmaceuticals

- ATR

- distribution

- 상관관계

- 자전거여행

- NASDAQ

- Apple

- 스트라이다

- correlation

- KRX

- stock

- bigdata

- kosdaq

- Ltd

- 미드저니

- Magic

- 태그를 입력해 주세요.

- AI

- Forex

- Trip

- story

- Histogram

- GPT

Archives

- Today

- Total

DATAUNION

30 days Rolling Correlation violin plot 본문

반응형

import pandas as pd

from sqlalchemy import create_engine

import seaborn as sns

import matplotlib.pyplot as plt

import numpy as np

# SQLAlchemy 엔진 설정

engine = create_engine("mysql+pymysql://root:1*****s@localhost/krxstock?charset=utf8")

# 모든 테이블 이름 가져오기

table_query = "SHOW TABLES"

tables = pd.read_sql(table_query, con=engine)

table_names = tables.iloc[:, 0].tolist()

# 날짜 설정

start_date = pd.Timestamp('2023-01-01')

end_date = pd.Timestamp('2023-03-30')

# 세 종목에 대해 실행

for stock_code in ['a017670', 'a056080', 'a005930']:

# 특정 종목의 'close' 데이터 가져오기

query = f"SELECT date, close FROM {stock_code}"

df_stock = pd.read_sql(query, con=engine)

df_stock['date'] = pd.to_datetime(df_stock['date'])

df_stock.set_index('date', inplace=True)

df_stock = df_stock.loc[start_date:end_date]

# 상관계수를 저장할 리스트 생성

correlation_data = []

# 모든 테이블에 대한 'close' 값 상관계수 계산

for table in table_names:

if table == stock_code:

continue

query = f"SELECT date, close FROM {table}"

df = pd.read_sql(query, con=engine)

df['date'] = pd.to_datetime(df['date'])

df.set_index('date', inplace=True)

# 두 데이터프레임을 병합

merged_df = pd.merge(df_stock, df, left_index=True, right_index=True, how='inner', suffixes=(f'_{stock_code}', f'_{table}'))

# 30일 롤링 윈도우로 상관계수 계산

rolling_corr = merged_df[f'close_{stock_code}'].rolling(window=30).corr(merged_df[f'close_{table}'])

# 지정된 날짜 범위의 데이터만 필터링

filtered_corr = rolling_corr.loc[start_date:end_date]

# 일별로 분류하고 평균 상관계수 계산

for date, group in filtered_corr.groupby(filtered_corr.index):

correlation_data.append({'Date': date, 'Correlation': group.mean()})

# 데이터 프레임으로 변환

df_corr_by_day = pd.DataFrame(correlation_data)

df_corr_by_day.set_index('Date', inplace=True)

# NaN과 inf 값 제거

df_corr_by_day = df_corr_by_day.dropna()

df_corr_by_day = df_corr_by_day.replace([np.inf, -np.inf], np.nan).dropna()

# CSV 파일로 저장

csv_filename = f"{stock_code}_correlation_data.csv"

df_corr_by_day.to_csv(csv_filename)

# Close Price 시계열 차트

plt.figure(figsize=(16, 8))

plt.plot(df_stock.index, df_stock['close'], color='tab:red')

plt.title(f'Close Price of {stock_code}')

plt.xlabel('Date')

plt.ylabel('Close Price')

plt.show()

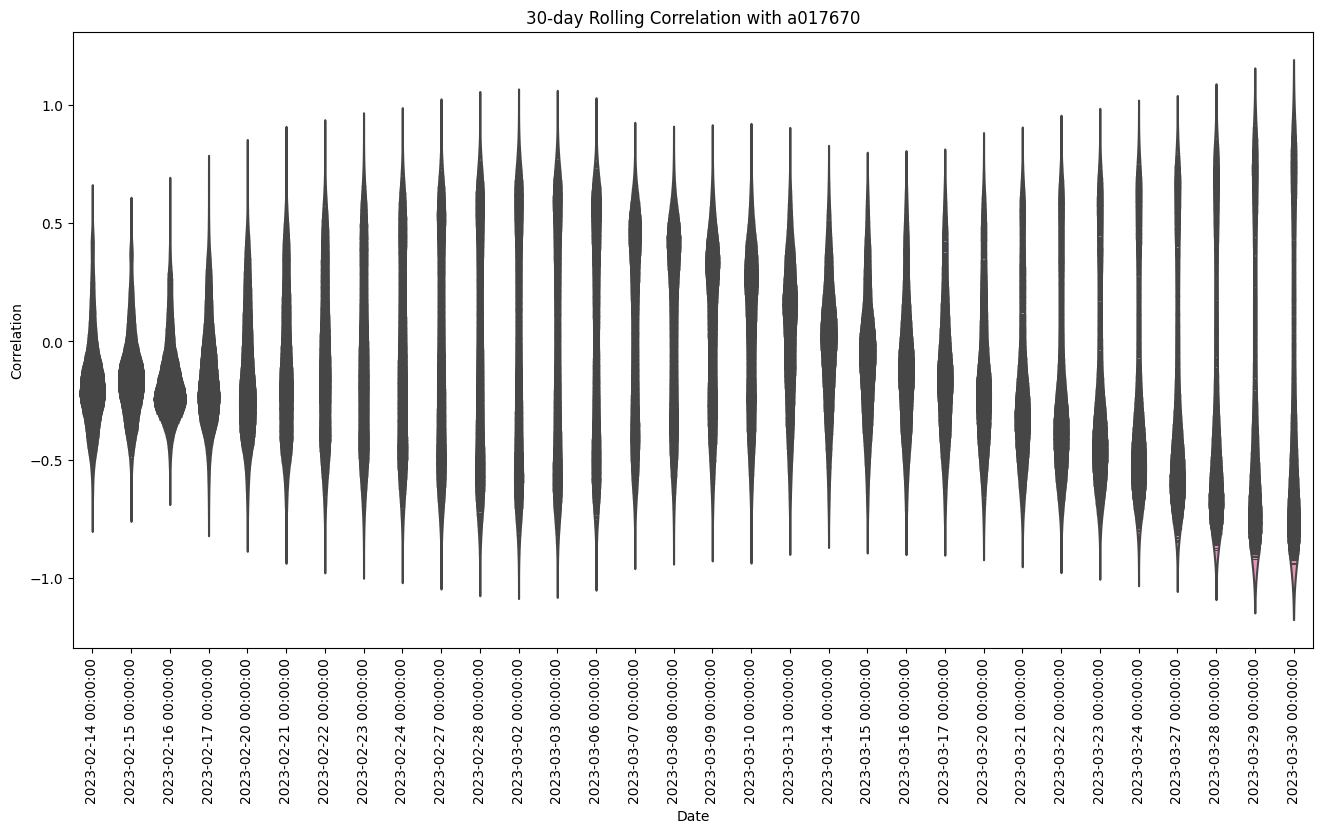

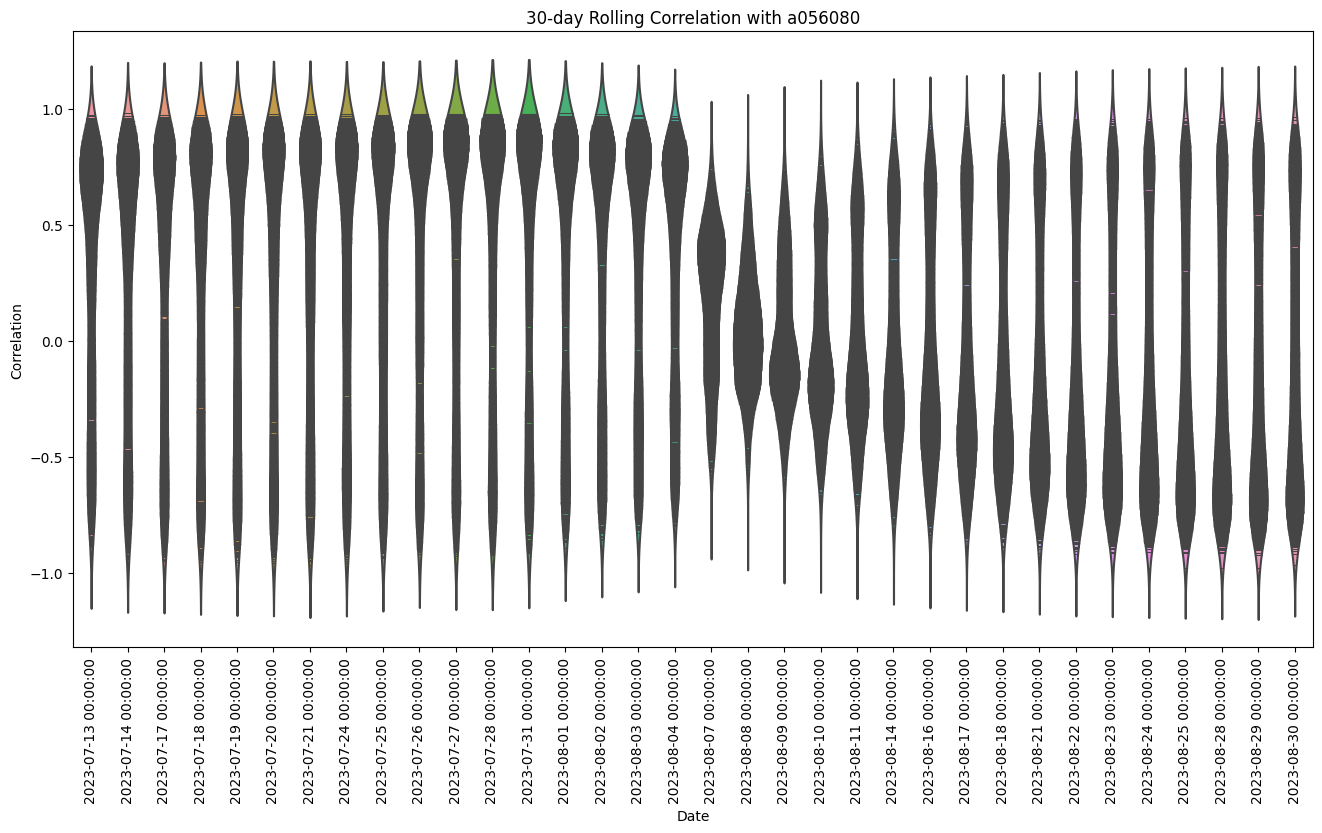

# Violin Plot for Correlations

plt.figure(figsize=(16, 8))

sns.violinplot(x=df_corr_by_day.index, y=df_corr_by_day['Correlation'], inner='stick')

plt.title(f'30-day Rolling Correlation with {stock_code}')

plt.xlabel('Date')

plt.ylabel('Correlation')

plt.xticks(rotation=90)

plt.show()

# 연결 종료

engine.dispose()

https://chat.openai.com/g/g-X1vYUg5J2-dataunion

If you have any questions, contact GPT and get insight!!

ChatGPT - DATAUNION

Stock Analysis

chat.openai.com

반응형

'Analysis' 카테고리의 다른 글

| Correlation distribution 이 무엇인가? (0) | 2024.01.31 |

|---|---|

| SK텔레콤 Distribution of Correlation Coefficients by Year with a017670 Close Prices (0) | 2024.01.28 |

| Portfolios recommended by chatGPT (0) | 2023.02.19 |

| [python] 2021 NASDAQ CORRELATION HISTOGRAM (0) | 2021.01.09 |

| Bitcoin Correlation Histogram (0) | 2017.05.21 |