X axis : Stocks Price Correlation Coefficient

Y axis : Quantity of stocks

1,000 Day Parameter

3,214 LONDON Stocks Price

1. Zero Correlation Histogram |

- The stock pair is concentrated in the correlation coefficient zero. |

- Case the diversification, Zero type will Overweight of the portfolio. |

- And, Zero type are often low volatility. |

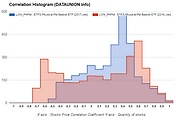

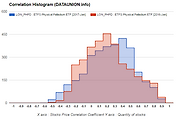

2. Type A Correlation Histogram |

- The stock pair is concentrated in the plus high correlation coefficient and minus high correlation coefficient. |

- The A type will underweight of the portfolio. |

- This is not a normal distribution. |

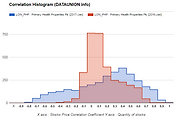

3. Type B Correlation Histogram |

- The stock pair is concentrated in the plus high correlation coefficient. |

- The B type will underweight of the portfolio. |

- This is not a normal distribution. |

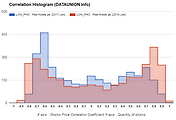

4. Type C Correlation Histogram |

- The stock pair is concentrated in the minus high correlation coefficient. |

- The C type will underweight of the portfolio. |

- This is not a normal distribution. |

Information is provided "as is" and solely for informational purposes, not for trading purposes or advice, and may be delayed.

Information provided by the investment decisions are not legally responsible for. In addition, the information posted can not be distributed without permission.

'LONDON' 카테고리의 다른 글

| ETFS Physical PM Basket ETF LONDON $LON_PHPM Correlation Histogram (0) | 2017.03.04 |

|---|---|

| ETFS Physical Palladium ETF LONDON $LON_PHPD Correlation Histogram (0) | 2017.03.04 |

| Primary Health Properties Plc LONDON $LON_PHP Correlation Histogram (0) | 2017.03.04 |

| Peel Hotels plc LONDON $LON_PHO Correlation Histogram (0) | 2017.03.04 |

| Phoenix Group Holdings LONDON $LON_PHNX Correlation Histogram (0) | 2017.03.04 |

댓글