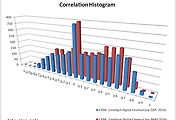

X axis : Stocks Price Correlation Coefficient |

Y axis : Quantity of stocks |

Sep-2016 |

1,000 Day Parameter |

2,830 NASDAQ Stocks Price |

Analysis |

This stock mode of correlation coefficient is -0.1 |

In other words, the correlation coefficient of the other stocks is the many levels -0.1 |

Kurtosis of the distribution of the correlation is -0.76, and skew is -0.04 |

Zero Correlation Histogram |

- The stock pair is concentrated in the correlation coefficient zero. |

- Case the diversification, Zero type will Overweight of the portfolio. |

- And, Zero type are often low volatility. |

Type A Correlation Histogram |

- The stock pair is concentrated in the plus high correlation coefficient and minus high correlation coefficient. |

- The A type will underweight of the portfolio. |

- This is not a normal distribution. |

Type B Correlation Histogram |

- The stock pair is concentrated in the plus high correlation coefficient. |

- The B type will underweight of the portfolio. |

- This is not a normal distribution. |

Type C Correlation Histogram |

- The stock pair is concentrated in the minus high correlation coefficient. |

- The C type will underweight of the portfolio. |

- This is not a normal distribution. |

Information is provided "as is" and solely for informational purposes, not for trading purposes or advice, and may be delayed. |

Information provided by the investment decisions are not legally responsible for. In addition, the information posted can not be distributed without permission. |

'NASDAQ' 카테고리의 다른 글

| Trust NASDAQ : CHXF Correlation Histogram (0) | 2016.10.28 |

|---|---|

| vertible & Hi Income Fund NASDAQ : CHY Correlation Histogram (0) | 2016.10.28 |

| gital Cinema Corp NASDAQ : CIDM Correlation Histogram (0) | 2016.10.28 |

| Ciena Corporation $CIEN Correlation Histogram (0) | 2016.10.28 |

| CIFC Corp NASDAQ : CIFC Correlation Histogram (0) | 2016.10.28 |

댓글